For a lot of young drivers, getting a license isn’t the hardest part of driving—the real shock comes when the first car insurance bill shows up. Between tuition, rent, and everyday expenses, fitting premiums into a tight budget can feel impossible.

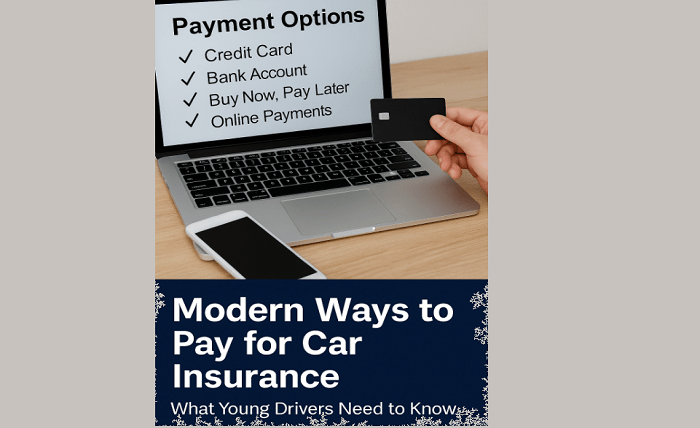

The good news? The way people pay for car insurance is changing just as fast as the way we listen to music or stream TV. New digital payment options, flexible schedules, and even “buy now, pay later” plans are making it easier to stay insured without completely wrecking your monthly budget.

In this guide, we’ll break down the most common payment methods, what’s changing in the market, and how to pick an option that works for your real life—not just for an ideal budget spreadsheet.

Why Payment Options Matter More Than Ever

Insurance companies know that Gen Z and young millennials often deal with:

- Irregular income (part-time gigs, freelance work, side hustles)

- Student loans or other debt

- Rising living costs in cities and college towns

- Limited credit history

Because of that, a one-size-fits-all “pay a big lump sum once or twice a year” model simply doesn’t work anymore. Flexible payment structures and digital tools are becoming part of the product itself—not just a side feature.

The Main Ways People Pay for Car Insurance Today

Here’s a quick overview of the most common payment methods you’ll see when you set up a policy.

- Credit or Debit Card

Still the default for many drivers. You can usually:

- Pay monthly or in full

- Save your card for automatic payments

- Earn rewards or cashback (with certain credit cards)

The downside? If your card is close to its limit or expires, you might miss a payment and risk a policy cancellation.

- Direct Withdrawal from a Bank Account

Many insurers let you link your checking account for automatic withdrawals. For some people, this feels more stable and easier to track than using a card. If you’re considering this route, it’s worth reading a full guide to paying for car insurance directly from a checking account so you understand the pros, cons, and timing of withdrawals.

- Buy Now, Pay Later (BNPL) Plans

“Buy now, pay later” used to be something you’d mainly see at online clothing or electronics stores. Now, it’s creeping into the insurance world too. Some providers or third-party platforms let you split a larger insurance bill into smaller, more manageable chunks over time.

If you’re just starting out and feel shut out of the traditional system, it can be helpful to explore how buy now, pay later car insurance options for young drivers work, and what terms you need to watch out for.

Comparing the Options: Which One Fits Your Life?

To make things easier, here’s a simplified comparison of the most popular payment paths.

Table 1 – Payment Methods at a Glance

| Payment Method | Best For | Biggest Advantage | Main Risk/Drawback |

| Credit card | People with stable credit & rewards cards | Potential cashback or points | Interest if you don’t pay off the balance |

| Debit card | Anyone who wants card convenience | Simple, familiar, quick | Card expiration or bank holds |

| Direct checking account withdrawal | Budget-focused drivers | Fewer missed payments, sometimes small discounts | Overdraft fees if balance is too low |

| Buy now, pay later (BNPL) for insurance | Young drivers needing short-term flexibility | Breaks a big bill into smaller pieces | Possible fees if you miss payments |

The “right” answer depends less on what’s trendy and more on your actual financial habits:

- Are you organized with due dates?

- Do you usually keep a buffer in your bank account?

- Are you trying to build credit—or avoid using credit at all?

How Flexible Payment Plans Are Changing the Game

The old “pay every six months or once a year” model is slowly being replaced by more creative structures. Some insurers now offer:

- Monthly or bi-weekly installmentsinstead of big lump sums

- Payment dates you can choose, aligned with your paydays

- Discounts for automatic payments, especially from a bank account

- Usage-based billing, where your monthly cost reflects how much and how safely you drive

For young drivers, that flexibility can be the difference between staying insured or letting a policy lapse when money gets tight.

Table 2 – Flexible Payment Features to Look For

| Feature | Why It Helps Young Drivers |

| Customizable due date | Lets you line up payments with payday |

| No hidden installment fees | Keeps small payments from secretly getting expensive |

| Mobile app or online portal | Makes it easy to change cards or bank info quickly |

| Clear late-fee policy | Avoids nasty surprises after one bad month |

If a company isn’t transparent about fees or makes it hard to see your upcoming payments, that’s a red flag—no matter how cool the app looks.

Pros and Cons of Paying from a Checking Account

Hooking your checking account directly to your insurer can feel a little intense at first, but it comes with real benefits.

Potential Benefits

- Less chance of a missed payment– No expired cards or declined transactions.

- Possible small discount– Some insurers reward “low-risk” payment methods.

- Cleaner budgeting– Payments come straight from your main money hub.

Things to Watch Out For

- Overdraft risk– If your balance is low when the withdrawal hits, you might get hit with bank fees.

- Timing issues– If you get paid on the 15th but your withdrawal hits on the 10th, that mismatch can cause problems.

- Need for close tracking– You’ll want to keep an eye on your transaction history and notifications.

Setting up alerts on your banking app—and knowing exactly when your insurance payment comes out—can keep things smooth.

Is “Buy Now, Pay Later” for Car Insurance a Good Idea?

BNPL-style car insurance isn’t magic money; it’s more like a structured way to break a big cost into smaller priorities. It can be helpful when:

- You’re starting a policy and the upfront cost is higher than expected

- You’re between jobs or transitioning from school to full-time work

- You need time to adjust your budget or build up a small emergency cushion

However, it’s essential to treat it with the same seriousness as any other loan or installment plan:

- Missed payments can mean fees or canceled coverage.

- Overusing BNPL can give you a false sense of what you can truly afford.

- You still need to read the fine print on interest, fees, and late-payment rules.

If you use BNPL to bridge a short-term gap and then switch to a simpler monthly plan once your finances stabilize, it can be a useful tool—not a trap.

Practical Tips for Keeping Your Coverage—and Your Sanity

Before you lock in a policy and a payment method, walk through this simple checklist:

- Know your true monthly budget

- List fixed expenses (rent, phone, streaming, transportation).

- Decide how much room you realistically have for insurance.

- Get at least three quotes

- Compare not just the price, but the coverage and deductible.

- Make notes about which companies offer flexible payments.

- Ask about discounts

- Good student, low mileage, safe driver, telematics programs, and multi-car policies can all bring the price down.

- Pick a payment date and stick to it

- Try to align it with your biggest paycheck or your student loan schedule.

- Turn on notifications in your banking and insurance apps.

- Revisit your coverage once a year

- If your situation changes—new job, fewer miles, moving to a different area—your rate might change too.

The Bottom Line

Car insurance will probably never be anyone’s favorite bill. But the way you pay for it doesn’t have to feel like a trap. Between checking-account withdrawals, card payments, and new buy-now-pay-later options, young drivers have more control than ever over how premiums fit into their financial lives.

The key is to treat payment options as part of your overall money strategy:

- Choose a method that matches your habits, not someone else’s.

- Look for tools and apps that make upcoming payments easy to see and manage.

- Use flexibility to support your stability—not to hide from the real cost.

Staying insured isn’t just a legal requirement; it’s a way of protecting your future self from a single accident wiping out your savings. With the right payment setup, that protection can feel less like a burden and more like one smart, steady move in your long-term financial story.